At Freeway Insurance coverage, we can help you make the right decisions while supplying you with automobile insurance choices that are lasting.

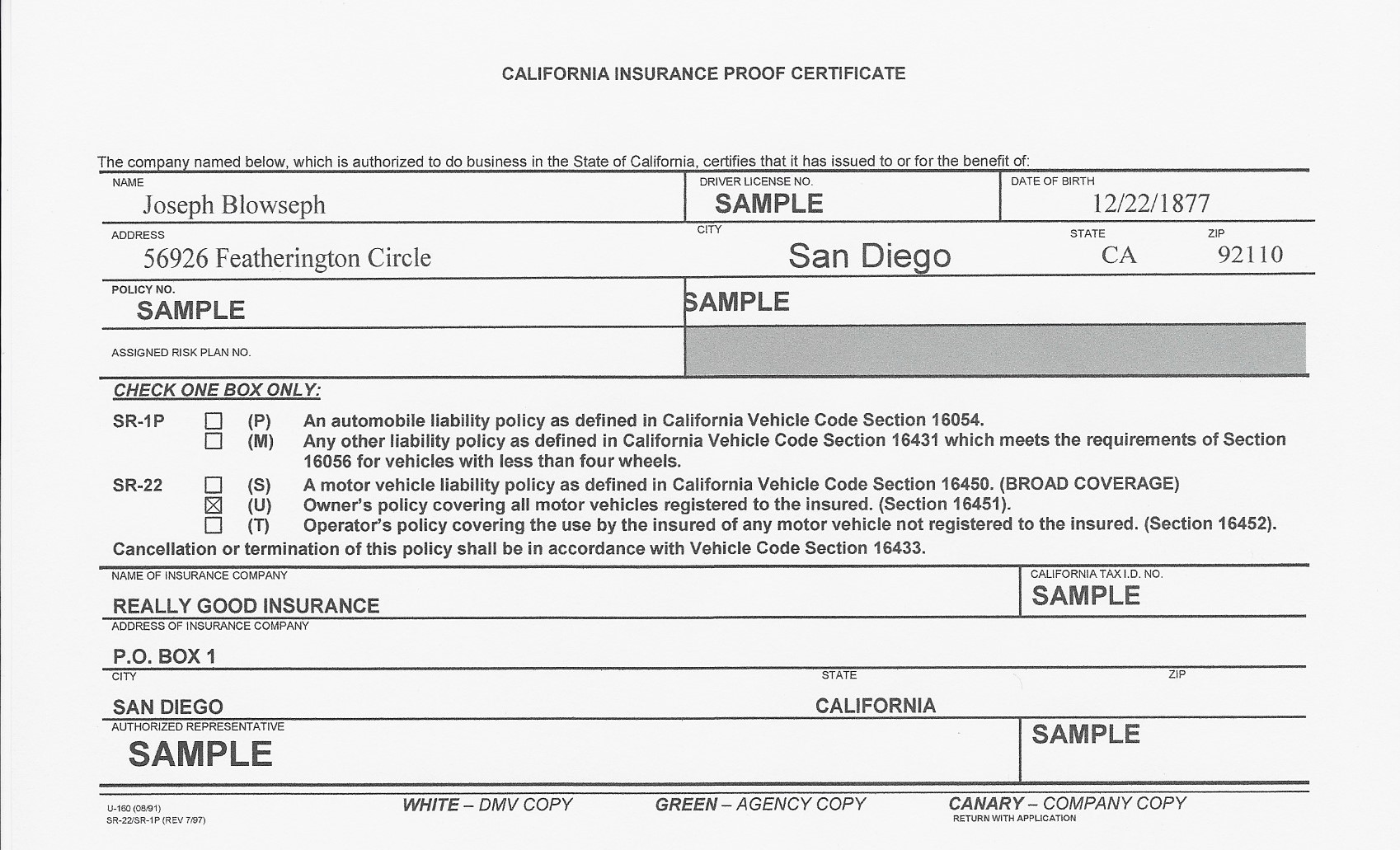

An SR-22 isn't actually car insurance policy. SR-22 is a type your insurer sends to the state's DMV revealing that you lug the minimum necessary Obligation protection. Commonly, an SR-22 is submitted with the state for 3 years.

That Requirements SR-22 Insurance in The Golden State? Not every driver requires to submit an SR-22 Form in California. They are only called for after you are convicted of a major website traffic infraction that results in you losing your chauffeurs permit. driver's license. An SR-22 Form is generally called for in The golden state after dedicating one or even more of the following infractions: Driving intoxicated (DUI)3 or even more small driving infractions, Driving without insurance, Careless driving, Having several traffic violations, California Minimum Insurance Obligation Demands, When purchasing an insurance coverage, you can (and must) boost your coverage limits, however the SR-22 type is indicated to verify you at least meet the obligatory minimum amount of insurance coverage.

However, you can opt-out of purchasing these insurance policy protections so long as you mention your rejection in composing. At the minimum, you need to satisfy the liability insurance coverage needs in The golden state. Everything else is optional, yet it is very advised that you purchase full insurance coverage for yourself and also your lorry.

It's likewise crucial to raise your coverage limitations as anything not paid for by your insurance policy company will certainly need to appear of your pocket. Enter your ZIP code below to check out quotes for the cheapest Automobile Insurance policy Rates. deductibles. How Long Will You Need SR-22 Insurance Coverage in The Golden State? Generally, many offenses in California need you to maintain SR-22 insurance coverage for 3 years.

The Best Strategy To Use For Best Sr-22 Insurance Options For 2022 - Benzinga

A court will certainly detail the specifics of your demand. It ought to likewise be noted that when your permit is revoked or suspended for a time period, the SR-22 insurance need starts after that. You must not allow your insurance protection lapse during your SR-22 insurance requirement period. If you do so, your insurer will have to notify the California DMV.

Attempting to get insurance after a gap in coverage can be tough, especially when you need an SR-22 plan included to your automobile insurance. If you move out of California during your SR-22 insurance policy duration, you will certainly need to locate an insurance company that does organization in both The golden state and also the state you are planning to relocate to.

As soon as your needed filing period is over, you will get free power of your automobile insurance policy choices. Just How Much Does SR-22 Insurance Policy Price in The Golden State? In California, the typical price of SR-22 insurance policy protection is around $1,600 annually. Insurance coverage prices can depend a whole lot on your sentence. Being founded guilty of a drunk driving can raise your rates dramatically, with some plans being virtually triple what the typical SR-22 policy as well as insurance policy protection prices per year.

Many insurance policy firms charge a filing charge of anywhere from $25-$50. In California, insurance policy business can not enhance your insurance coverage rates or terminate your insurance coverage policy in the middle of its term.

The golden state automobile insurance regulations additionally ban insurance provider from using excellent vehicle driver policy discount rates to any individual with a drunk driving for one decade complying with the sentence. Nevertheless, there are various other cars and truck insurance policy price cuts you can still enter California if you have a DRUNK DRIVING, like multi-policy or packing price cuts. Shedding a good vehicle driver policy price cut can be harmful to your insurance coverage prices as it can be the most impactful insurance price cut a business offers.

How Sr-22 Insurance - Safeauto can Save You Time, Stress, and Money.

A non-owner plan can provide you with the obligation insurance coverage needed in The golden state as well as will guarantee you are shielded should you finish up in an additional web traffic event. It is likewise a cheaper kind of protection when you compare it to conventional cars and truck insurance coverage. Do not consider this type of insurance coverage simply since it is considered reasonably inexpensive insurance coverage - no-fault insurance.

For instance, if you are an university student living in the house and have access to your parent's automobile, you will not certify for a non-owner insurance policy. This type of policy would certainly be optimal to get if you often rent cars and trucks. Everybody requires the appropriate insurance when behind the wheel (driver's license).

Drunk Driving Convictions in The Golden State, A DUI sentence is among the most significant website traffic offenses (insure). Even if it is your initial infraction, you will have raised automobile insurance rates together with satisfying an SR-22 insurance policy demand to reactivate your license after a DUI.Car insurance policy is not the only location you have to fret about complying with a DUI conviction.

Including what is detailed in the graph below, you will additionally have to pay a $125 enrollment cost as well as a $15 license reprinting cost after a DRUNK DRIVING.

An SR-22, typically described as SR-22 insurance policy, is a certification issued by your vehicle insurer giving evidence that you carry the called for minimum amount of lorry liability insurance coverage for your state. liability insurance. If you have been associated with a crash and also were not lugging minimal auto insurance coverage, the majority of state DMVs will certainly need you to file an SR-22.

Financial Responsibility > Insurance Requirements/sr-22 for Dummies

If a chauffeur is required to bring SR-22 and also she or he relocates to among these six states, they have to still remain to satisfy the demands legitimately mandated by their former state. All lorries in Washington and Oregon must bring a minimum obligation insurance coverage - motor vehicle safety. If a Washington driver has his/her certificate put on hold, the driver needs to give evidence of monetary obligation by submitting an SR22.

It is very recommended that the insured restore their plan at least forty-five (45) days beforehand (sr22 coverage). There are 2 (2) ways to stay clear of needing to acquire an SR-22 Washington recommendation. A driver can make a down payment of $60,000 to the State Treasurer or get a guaranty bond with a surety company such as Vern Fonk that is accredited to do service in Washington and Oregon.

A driver can not just reveal his insurance card as evidence. The insurance policy card will be needed by Oregon legislation, to be present in a vehicle that is operated Oregon freeways. driver's license. The DMV very closely keeps track of compliance with SR22 requirements, and also if the insurance lapses, the insurance provider by legislation is called for to inform the DMV of that fact as well as the driver's license will be suspended.

If your SR22 automobile insurance coverage is terminated, lapses or ends, your auto insurer is needed to alert the authorities in your state. (They do this by providing an SR26 type, which licenses the cancellation of the plan.) At that factor, your certificate might be suspended once again or the state may take other major actions that will limit your capacity to drive.

Failing to preserve your insurance policy protection might trigger you to shed your driving benefits once more and also your state may take various other activities versus you. It's ideal to maintain the SR22 for the entire mandated time period. State legislations relating to SR22 automobile insurance coverage requirements can be made complex (insurance). That's why it's so important to get trusted info and assistance from licensed insurance policy agents at reputable SR22 insurer.

The 25-Second Trick For Sr-22 - A-max Auto Insurance

Plus, experienced representatives will certainly be able to assist you locate an accepted cheap SR22 insurance plan. If you have much more questions regarding SR22 insurance coverage or any other service or products, drop in a Straight Car Insurance policy location near you or call a representative at 1-877-GO-DIRECT (1-877-463-4732). At Direct Automobile, you can obtain the affordable automobile insurance protection you require, the solutions you want, and the regard you deserveregardless of your insurance policy history.

As a high-risk vehicle driver, you may have even more to deal with than just finding insurance coverage. In addition to your vehicle policy, you might additionally need SR-22 insurance policy in Colorado. While all of these policies may seem complex, our team at Select Insurance Group can aid you navigate the SR-22 needs and answer your concerns concerning the policies you need.

You should have SR-22 insurance policy to obtain your license restored. The SR-22 is not an insurance policy itself instead, it reveals that you can afford insurance policy.

Maintain in mind SR-22 certification costs remain in addition to the rates you will pay for your regular vehicle insurance coverage - vehicle insurance.

FOR HOW LONG IS AN SR-22 VALID? Each state has its very own demands for the length of time that an SR-22 have to be in area (liability insurance). As long as you pay the needed costs and also to maintain your policy active, the SR-22 will stay essentially up until the requirements for your state have actually been satisfied.

See This Report about How Much Does Sr22 Insurance Cost A Month? Average ...

WHAT IS THE DIFFERENCE BETWEEN AN SR-22 AS WELL AS AN FR-44? In the states of Florida as well as Virginia, an FR-44 is a "Certificate of Financial Responsibility" - motor vehicle safety. It resembles an SR-22, but an FR-44 normally needs greater responsibility restrictions. EXIST ANY COSTS FOR DECLARING AN SR-22? A lot of states need a small declaring cost when an SR-22 is very first filed.

At Safe, Automobile, we understand that purchasing automobile insurance policy coverage can be demanding and also expensive. You can call a specialized Safe, Auto customer care rep at 1-800-SAFEAUTO (1-800-723-3288) to ask for an SR-22 be filed. sr22 insurance.

You do not require to have a vehicle to buy this sort of insurance policy. If you do not own an auto, ask your insurer concerning a non-owner SR-22 plan. For many offenses, you must lug this type of insurance coverage for 3 years from the ending day of any revocation.

Which states need SR-22s? Each state has its own SR-22 coverage demands for vehicle drivers, as well as all undergo transform. Connect with your insurance coverage service provider to figure out your state's current requirements and make sure you have ample insurance coverage. Exactly how long do you require an SR-22? The majority of states need drivers to have an SR-22to show they have insurancefor regarding 3 years (vehicle insurance).

(Mon-Fri, 8am 5pm PST) for a or fill in this type: three to five times even more than the typical numbers if your motorist's permit has been suspended or revoked. While the expense of getting the SR22 certification is unimportant (in the series of $25 or less), the actual premiums you will need to pay depend upon the seriousness of the violation as well as the threat you presently position to the insurance provider.

10 Simple Techniques For What Is Sr-22 Insurance And How Much Does It Cost?

A 19 years of age vehicle driver with a DUI conviction might or may not pay greater than a 40 year old one with the same conviction - auto insurance. Although teenage chauffeurs are normally billed extra, it can be that the elder chauffeur has an extra expensive vehicle, a careless driving background, more than one car or even more motorists on the same policy.

The rates go down as you come close to 40 and also have a tendency to return up when you are in your late fifties. It do without claiming that the a lot more expensive the auto is, the a lot more it will set you back to guarantee it. Yet factors like full throttle and also 0-60mph time are thought about also, so a sporting activities automobile will be more pricey to insure than a limo in the exact same rate array.

A motorist with a pristine document will certainly pay much less than one who files a case every various other month. Taking a protective driving program could make you rack up much better. The severity of the infraction that bring about the SR22 need is additionally to be taken into consideration drunk driving's are thought about a lot more major than obtaining numerous speeding tickets in a brief period of time.

Your three-year SR22 requirement will be reset in Texas. insurance group. Considering that costs for routine coverage vary from one insurer to one more, you can just think of just how much cash you can save from looking around. Do not shut a take care of the initial insurance provider you face! (Mon-Fri, 8am 5pm PST) for a or complete this kind:.