At Relax Insurance coverage, we can help you discover the best feasible prices on non-owner auto insurance to save you the maximum amount of cash. For a free quote on non-owner coverage as well as SR22 from Breathe Easy Insurance policy, demand a quote online or call us today at 833 (insurance coverage). 786.0237 (driver's license).

SR-22 Insurance policy can just be gotten through an insurance coverage service provider (insurance coverage). SR-22 insurance has a significant influence on your prices in California, and those rates can differ considerably from one company to an additional. Limitations for An SR-22 Insurance Coverage in The golden state At the minimum, you need the coverage listed below if you are needed to have SR-22 insurance in The golden state (underinsured).

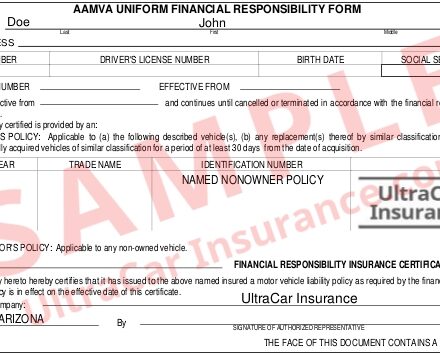

The exact same situation puts on those who do not have a car. sr22 insurance. Non-owner auto insurance policy is the perfect alternative for those that do not have an auto considering that regular auto insurance coverage can be pricey. department of motor vehicles. That suggests that such individuals will certainly be covered in case of another crash, and they can additionally show proof of obligation insurance policy coverage to obtain their license restored. sr22 coverage.

The reason that non-owner SR-22 insurance coverage is more affordable is that the insurance provider thinks that you do not drive typically, and the only insurance coverage you obtain, in this instance, is for liability just - sr22 insurance. If you rent or borrow lorries often, you should consider non-owner vehicle insurance coverage as well (credit score). Although prices can differ throughout insurance providers, the average annual cost for non-owner vehicle insurance policy in The golden state stands at $932.

Average Cost (And Cheapest) Non-owner Sr-22 Insurance Things To Know Before You Buy

Demands for An SR-22 in California First, comprehend that an SR-22 affects your car insurance cost as well as protection (insurance). As an example, after a DUI sentence in The golden state, standard motorists pay approximately 166% greater than automobile insurance coverage for SR-22 insurance policy. department of motor vehicles. The minimal period for having an SR-22 in The golden state is three years, but one might need it longer than that, relying on their instance and also infraction.

In any of these scenarios, an SR-26 kind can be submitted by your insurance provider. When that happens, your insurance provider ought to show that you no more have insurance policy coverage with the entity. Starting the SR-22 process over again will certainly be necessary if your firm submits an SR-26 prior to finishing your SR-22 need. insurance.

MIS-Insurance deals low-cost SR22 insurance policy that will certainly conserve you money over the life of your plan. Budget-friendly SR22 insurance policy is readily available and we will certainly can aid you secure the ideal policy for you.

A DUI will automatically boost your prices without thinking about additional price boosts as well as deny you price cuts even if you were previously obtaining a good chauffeur price cut. Instead of paying $100 regular monthly for car insurance, a chauffeur with no DUI background will only pay $80 monthly, many thanks to the 20% excellent chauffeur price cut they receive. credit score.

The Ultimate Guide To Sr-22 Car Insurance Basics

What you require to learn about SR-22 Declaring in California When it concerns concerns relating to vehicle insurance, our driving documents, and also rights and advantages, occasionally we are taught things that merely are not true. dui. Allow's look at a few of one of the most usual myths and misunderstandings concerning the SR-22 The golden state: What is the SR-22 Chauffeur Filing? An SR-22 is a certificate of insurance submitted by your insurance provider straight to the Division of Motor Vehicles - sr-22.

SR-22 Minimum Liability Boundary The minimum obligation limits must fulfill your state's requirements. Your Cost-U-Less client service rep can tell you what the minimum requirements are for your state. Exactly How the SR-22 Declaring Refine Works There is not much for you to do in this process. All you need to do is request your insurer to file an SR-22 for you, then the insurance provider cares for the remainder.

Prevent Future SR-22 Cancellations as well as Suspensions Once you have your SR-22 coverage, you want to make sure it does not obtain cancelled or put on hold - dui. The earlier you renew it, the much safer you'll be as well as the much less likely your SR-22 will be cancelled - insurance.