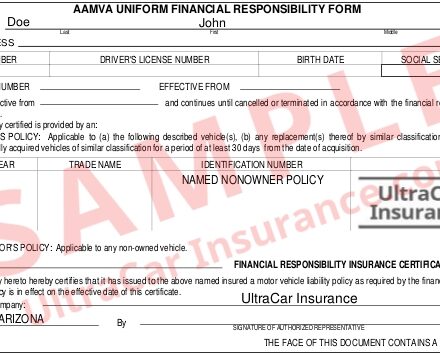

You might locate on your own in a circumstance where you're called for to submit an SR22 to your state. What is an SR22, you question? It's absolutely nothing elegant, simply a type that states you have purchased the car insurance coverage called for by your state. An SR22 is additionally referred to as a Certification of Financial Responsibility.

Is an SR22 proof of insurance policy? Your proof of insurance coverage will certainly be obtained when you provide the state with an SR22 form. You can acquire the type by speaking to a car insurer in the state where you need insurance policy. The insurance coverage business will certainly provide you with the SR22 or they will mail it directly to the state.

Have you been purchased to supply the state with proof of monetary responsibility? If so, what is the most effective insurance SR22 for vehicle drivers? Utilize our useful overview to narrow down your selections. What Is an SR22? If the state lately charged you with a major website traffic violation, you may deal with an automobile insurance need that you have actually never experienced before, claims Geek Purse.

Having to submit an SR22 to your state's car department can include greater premiums and a minimal number of carriers to select from, although going shopping around for the very best rates can help in reducing some prices. An SR22 certification isn't practically an insurance coverage. It's actually a type that a carrier files with the state in support of risky drivers with countless traffic offenses or a suspended certificate.

3 Simple Techniques For Free Texas Sr22 Filing - Abc Insurance Services

Pay the SR22 declaring fee. Your insurer files the SR22 in your place with your state's DMV.Await verification from the DMV, which could take up to 2 weeks per Clearsurance (insurance group). How much time Do You Required to Carry an SR22? Vehicle drivers commonly figure out they require to submit an SR22 certification throughout a court hearing, records experts at Discover a provider that will give this type for your entire sentence, normally 3 to five years in many states.

Your SR22 will remain active as long as your automobile insurance plan is valid. If you cancel your policy, the state may suspend your permit, and also the moment lapsed will not count toward meeting your mandated sentence. As an example: The judge purchased you to submit an SR22 for 4 years, however you cancel your insurance plan after simply one year.

At American Car Insurance policy, we obtain a great deal of concerns from potential clients about SR-22 insurance. We prepared this guide to assist our existing customers, prospective customers, and also any individual else curious about finding out a little bit more concerning SR-22 insurance policy. If you have actually experienced a lapse in your driving opportunities or automobile insurance policy coverage, you may be called for by the Illinois Assistant of State to acquire SR-22 insurance.

The Illinois Secretary of State's office will inform you if you need an SR-22. Then, get in touch with a car insurance provider to get your SR-22 insurance policy quotes. Realize that not all insurer supply SR-22 insurance, so you'll require to locate one that does. American Car Insurance policy supplies inexpensive SR-22 insurance policy in Chicago & Champaign.

The Facts About Next Insurance: Small Business Insurance Quotes Uncovered

The SR-22 kind can be filed as a paper record or digitally. At American Auto Insurance policy, we use digital declaring to guarantee your SR-22 is done swiftly and easily.

This implies your automobile insurance plan have to continuously be current and paid. If your plan expires or there is a gap in your protection, your auto insurance carrier is called for to notify the state. sr-22 insurance. The state can after that revoke or suspend your driving advantages, and you will need to begin the procedure over again.

The Assistant of State will certainly validate the deposit by issuing you a certification. coverage. An actual estate bond or surety bond are other options to SR-22.

Non-owner SR-22 insurance, on the other hand, will certainly cover you as a vehicle driver of any type of automobile you do not very own, such as a cars and truck you rent out or obtain - sr22 coverage. By doing this, you can follow Illinois lawful requirements while still driving someone else's automobile! It is worth discussing that a non-owner SR-22 insurance coverage costs substantially much less than other policies since it just covers an individual for responsibility.

The Definitive Guide to Florida's Sr22 Insurance Agency

Nonetheless, a non-owner policy may not cover the vehicle owned or frequently made use of by the convicted motorist. The risk to the lorry you are driving remains, the higher limits you buy for a non-owner policy to cover will provide you better assurance in the case of a costly mishap.

The providing firm additionally must have a power of attorney on file in Illinois. The SR-22 should be submitted on a Financial Responsibility Certification from the house office of the insurance provider. bureau of motor vehicles. The SR-22 certification is provided in one of the following kinds: Driver's Certificate covers the vehicle driver in the procedure of any kind of non-owned lorry.

The type of lorry should be detailed on the SR-22 or might be provided for all had lorries. Operators-Owners Certification covers all automobiles had or non-owned by the motorist. When settlement is made to an insurance agency, the representative will certainly submit an ask for an SR-22 certification to the central workplace.

The person will receive a copy of the SR-22 from the insurance provider as well as a letter from the Assistant of State's workplace. The insurance policy has to be kept for three years. If the SR-22 ends or is cancelled, the insurer is required by law to alert the Security and also Monetary Responsibility Section by a SR-26 Cancellation Certificate - sr-22.

What Does Sr-22 In Florida - Bankrate Mean?

Out-of-state locals may request their proof of economic obligation for Illinois be waived by finishing an Sworn statement - motor vehicle safety. The sworn statement applies only to Illinois' insurance policy demands. In the event you return to Illinois within three years from approval of the insurance waiver, your SR-22 need for Illinois would certainly be restored.

If you're thought about a risky driver such as one that's been convicted of numerous traffic violations or has obtained a drunk driving you'll probably have to come to be accustomed to an SR-22. What is an SR-22? An SR-22 is a certificate of monetary responsibility required for some chauffeurs by their state or court order.

Depending on your scenario and what state you live in, an FR-44 might take the area of the SR-22. How does an SR-22 work?

1 It's up to your automobile insurance provider to submit an SR-22 type for you. You may have the ability to include this onto an existing policy, but maintain in mind that not every vehicle insurer wants to supply SR-22 insurance coverage - insurance. In this case, you'll have to shop for a brand-new policy.

The Definitive Guide to What Is Sr-22 Insurance And How Much Does It Cost?

On top of that, submitting an SR-22 is a crucial step in acquiring a difficulty or probationary license. 3 Exactly how long will you need to have it? In the majority of states, an SR-22 is required for 3 years, yet you ought to call your state's DMV to find out the exactly for how long you'll require it.

This can result in your motorist's certificate being suspended or withdrawed. You might even need to start the SR-22 process all over once again (car insurance). Try to understand any kind of other criteria that control your SR-22. You'll desire to figure out if your SR-22 duration starts on your driving crime date, the license suspension day, the day you renewed your certificate, or one more date.

3 The filing procedures for the SR-22 as well as FR-44 are comparable in several methods. Some of the important points they have in typical include4,5,6: FR-44s are generally needed via court order, or you can validate your demand for one by contacting your regional DMV. Your cars and truck insurance provider will file your FR-44 on your part with the state's motor automobile authority.

For context, the minimum responsibility coverage for a typical vehicle driver is just $10,000 for physical injury or death of a single person - sr22 coverage. 7 Where to get an SR-22 If you think you need an SR-22, consult an insurance policy agent. They'll be able to direct you via the whole SR-22 filing process and also make certain you're fulfilling your state's insurance policies.

Sr22 Insurance In Chicago, Illinois for Dummies

An SR-22, generally described as SR-22 insurance policy, is a qualification issued by your automobile insurer giving evidence that you bring the called for minimum amount of car liability protection for your state - insurance companies. If you have actually been entailed in a mishap and also were not lugging minimum vehicle insurance, many state DMVs will certainly need you to submit an SR-22.

It is extremely recommended that the insured restore their policy at least forty-five (45) days beforehand. There are 2 (2) ways to prevent needing to get an SR-22 Washington endorsement. A driver can make a down payment of $60,000 to the State Treasurer or acquire a guaranty bond through a guaranty business such as Vern Fonk that is accredited to do company in Washington and also Oregon. car insurance.

A driver can not simply show his insurance card as proof. The insurance card will be needed by Oregon law, to be existing in a vehicle that is operated Oregon freeways. The DMV closely checks conformity with SR22 requirements, and also if the insurance policy gaps, the insurance firm by legislation is called for to inform the DMV of that as well as the motorist's license will certainly be suspended. insure.

An insurance card or policy will certainly not be accepted in place of an SR-22. What Are One Of The Most Typical Factors Vehicle Drivers Obtain An SR-22? Vehicle drivers request an SR-22 certification for countless factors; nevertheless, frequently it's to aid guarantee the Department of Electric Motor Automobiles that you have the fundamental insurance policy protection as called for by regulation.

3 Easy Facts About What Is Sr-22 Insurance And What Does It Do? - Allstate Described

If you've been requested to submit an SR-22 since you didn't have insurance at the time you'll initially have to obtain state minimum insurance coverage as well which will be charged individually from the SR-22 declaring. If you currently have car insurance and also the state has actually requested an SR-22 declaring then you need to call them for a price quote.

Will an SR-22 Insurance Certification Raise My Automobile Insurance Coverage Rates? It is not likely that having an SR-22 certification filed with the state would certainly enhance your insurance policy prices.

SR-22 Insurance coverage can only be acquired via an insurance service provider - ignition interlock. SR-22 insurance policy has a significant influence on your prices in California, and those prices can differ dramatically from one company to another. Restrictions for An SR-22 Insurance Coverage in California At the minimum, you require the insurance coverage listed here if you are needed to have SR-22 insurance in California.

It is highly advised that the insured renew their plan a minimum of forty-five (45) days in advance. There are two (2) ways to prevent needing to obtain an SR-22 Washington recommendation. A motorist can make a deposit of $60,000 to the State Treasurer or get a surety bond through a guaranty business such as Vern Fonk that is licensed to do company in Washington as well as Oregon.

5 Simple Techniques For What Is Sr22 Insurance? Everything You Need To Know [2022]

A chauffeur can not simply show his insurance coverage card as proof. The insurance coverage card will be needed by Oregon regulation, to be existing in a car that is operated Oregon highways. The DMV very closely monitors compliance with SR22 needs, and also if the insurance lapses, the insurance provider by legislation is called for to notify the DMV of that fact as well as the vehicle driver's permit will be suspended (division of motor vehicles).

An insurance policy card or policy will not be approved in area of an SR-22. What Are The Many Typical Factors Chauffeurs Obtain An SR-22? Chauffeurs ask for an SR-22 certificate for numerous factors; nevertheless, most often it's to assist guarantee the Division of Electric Motor Automobiles that you have the fundamental insurance coverage as needed by law. motor vehicle safety.

If you've been asked for to file an SR-22 due to the fact that you didn't have insurance coverage at the time you'll first need to obtain state minimum insurance coverage too which will be billed separately from the SR-22 filing. If you already have automobile insurance and the state has actually requested an SR-22 declaring then you should call them for a price quote.

Will an SR-22 Insurance Certificate Increase My Vehicle Insurance Rates? It is not likely that having an SR-22 certification submitted with the state would certainly increase your insurance coverage prices. Depending upon the factor you're filing an SR-22, however, your insurance policy business might elevate your rates based upon those reasons. Your existing insurance policy firm may raise your rates even more than others would certainly. sr-22.

The 45-Second Trick For What Is Sr22 Insurance? - Lemonade

SR-22 Insurance coverage can just be acquired via an insurance policy provider. SR-22 insurance has a substantial effect on your rates in California, and those rates can differ significantly from one business to another. Limits for An SR-22 Insurance Coverage in The golden state At the minimum, you need the insurance coverage listed here if you are required to have SR-22 insurance in California.