Currently, given that your insurer is the one in charge of sending the real file, they tackle this charge when the filing is done, then they will bill you individually or include the expense to your next insurance coverage bill - coverage. In some cases you may be called for to have SR-22 insurance for multiple years, in which situation you only pay a charge when for it to be filed the initial time.

Be advised that if there is a lapsemeaning, you did not ask for the renewal to be refined on timethen you will certainly have to pay once more due to the fact that you will certainly need new proof of insurance coverage. dui. Generally talking, you will need to have this certification of coverage for 3 years. Nevertheless, the real size of time is contingent upon: where you live and what your state legislations are, andwhy the courts needed this protection of you.

If there was a less unsafe factor, it may be just 2 years. The insurance coverage stays valid for as long as you keep your insurance plan. If, for any type of factor, you terminate this policy or there was a lapse in between revivals, your car insurance coverage will notify your state authorities.

For example, if you are asked to have SR-22 for 3 years, however after that you cancel your insurance coverage policy after 2 years, the state will likely suspend your permit if it had been previously suspended - insure. They will certainly then press a metaphorical pause on that 3 year mark and as soon as you determine to buy a brand-new insurance coverage policy in the future, they will certainly begin it up again.

The length of time you are required by your state to bring the insurance can be extended if, during that time, you enter into an auto crash or a website traffic offense. The courts can prolong the time you require this insurance policy, which can boost the expense of your insurance coverage. The reason the price goes up is since extra violations tells your insurance that you are a risky vehicle driver - sr22 insurance.

The Ultimate Guide To American Family Insurance: Auto, Home, Life, & More

This is form SR26. If you pick an AAMVA declaring electronically then this will be instantly done at the end of your required time. (Mon-Fri, 8am 5pm PST) for a or complete this type: Locating a close to you is not impossible. Any type of insurance service provider in any type of state can offer this insurance coverage, but not every one of them do.

Also if they maintain you on as a policyholder, they can increase the price substantially. Insurance suppliers establish the quantity of money you pay for your insurance coverage based upon how safe a driver you are, which is why many individuals can get discounts on automobile insurance by taking secure driving programs or going multiple years without violations or having a digital system track exactly how safely they drive.

These are the leading 10 insurance suppliers for. In order to obtain your insurance policy protection up to day, you will certainly need to obtain a quote for SR-22 insurance policy.

You can get a totally free quote just loading the kind on the top of this page, as well as in a couple of mins you'll compare numerous cost effective SR-22 insurance coverage quotes (underinsured). Depending upon your state, and the factor for your infraction, you may need to file additional different forms. SR-21 Insurance, This is a comparable type but it demonstrates that you have proof of automobile insurance.

SR-50 Insurance, If you live in the state of Indiana this might be the alternate insurance coverage you are called for to lug. This is comparable and is indicated to assist you obtain your licensed restored after it has actually been put on hold due to your infraction. insurance coverage. (Mon-Fri, 8am 5pm PST) for a of an inexpensive SR22 insurance, or fill up out this type:.

Rumored Buzz on The Best Sr22 Insurance Guide

sr22 coverage insurance companies division of motor vehicles insurance group dui

sr22 coverage insurance companies division of motor vehicles insurance group dui

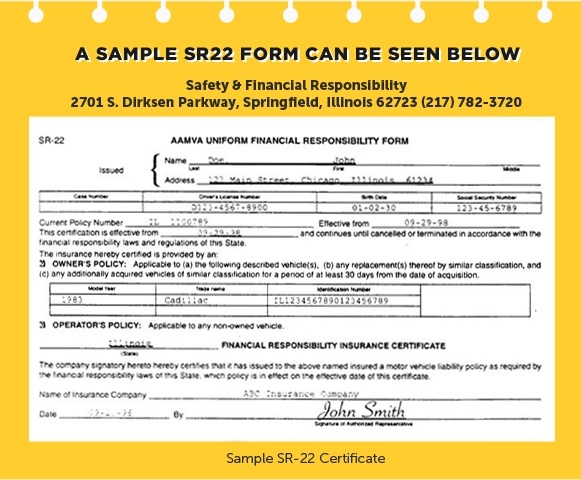

What is an SR-22? Often referred to as "SR-22 Insurance", an SR-22 is usually required for vehicle drivers that have had their vehicle driver's licenses put on hold as a result of: DRUNK DRIVING/ dui sentences Multiple website traffic offenses Driving without insurance coverage License plates being expired A high variety of factors on a driving document An SR-22 is a certificate of financial obligation that is filed with the Illinois Assistant of State's workplace - insurance.

United Automobile Insurance Coverage deals same-day automobile insurance policy. The certification informs the State of Illinois that you have liability coverage as well as if your protection is canceled or expires. As this can be a confusing procedure, we provided some response to regularly asked questions pertaining to SR-22 Insurance policy (sr-22). If you need a quote for your SR-22, please get a cost-free quote.

We will certainly make certain that you have an up to date automobile insurance coverage policy to go along with the check here SR-22. Obtain the lowest rate and also Get a totally free SR-22 insurance quote currently. Sent directly to the Illinois Assistant of State workplace as well as can take up to thirty days to procedure - underinsured.

You have to first purchase Responsibility or Full Protection insurance coverage as well as the expense will certainly depend on your age, driving document, kind of lorry, and additional insurance policy variables. Be sure to call United Car Insurance policy for a quote on the least expensive rate.

For an SR-22 quote, get a complimentary quote currently. United Car Insurance is the auto insurer right here to aid you with your automobile insurance policy needs. Provide us a phone call at 773-202-5000 or obtain a totally free quote today. Commitments are satisfied, the SR-22 status will be removed. At that time, it will certainly be very important to review your insurance policy with United Auto Insurance as well as make certain that you proceed to stay covered.

The Best Sr22 Insurance (Recommended) for Beginners

United Car Insurance Policy is below for you in the occasion that you require an SR-22 certification as well as insurance coverage plan. Bad points can take place to great individuals, so we understand that having the ideal team on your side to aid you clean up any kind of mistakes is essential. The very best method to handle an SR-22 requirement is to call us sooner as opposed to later on to avoid any higher threats and recognize that you are covered.

This info is suggested for instructional functions and also is not intended to change information acquired via the quoting procedure. This details may change as insurance coverage and protection modification.

SR-22 Insurance policy can just be acquired via an insurance policy carrier. SR-22 insurance coverage has a substantial effect on your rates in The golden state, and those prices can differ considerably from one firm to one more. Limits for An SR-22 Insurance in California At the minimum, you require the protection detailed below if you are called for to have SR-22 insurance in The golden state.

sr-22 sr-22 insurance companies credit score insurance

sr-22 sr-22 insurance companies credit score insurance

The reason why non-owner SR-22 insurance is less expensive is that the insurance firm assumes that you do not drive typically, and also the only coverage you obtain, in this instance, is for liability only. If you lease or borrow vehicles frequently, you must think about non-owner auto insurance policy also. Although rates can vary throughout insurance firms, the ordinary yearly cost for non-owner cars and truck insurance in California stands at $932.

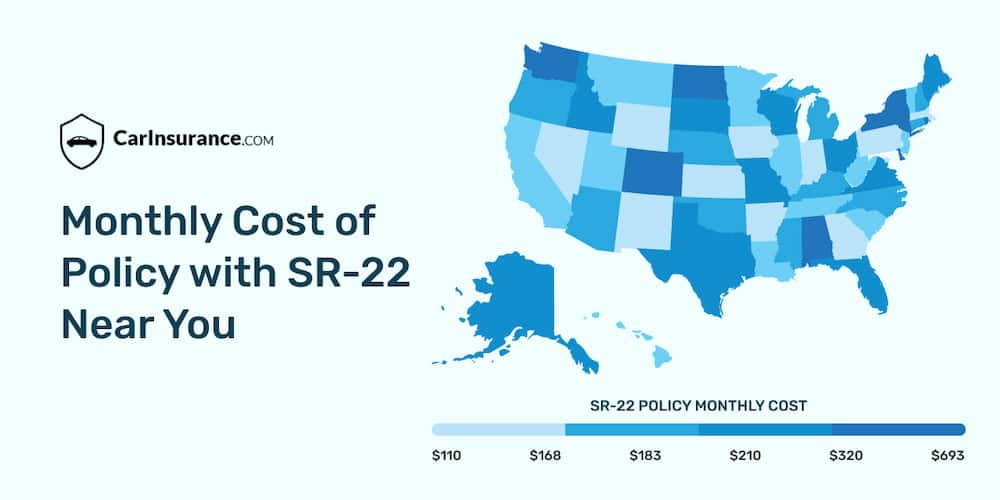

Needs for An SR-22 in The golden state First, recognize that an SR-22 affects your vehicle insurance price and also protection. After a DUI sentence in The golden state, standard motorists pay an average of 166% more than vehicle insurance coverage for SR-22 insurance. The minimum duration for having an SR-22 in California is 3 years, yet one may require it longer than that, relying on their case and also infraction.

The Sr22 Insurance California, The Cheapest! From $7/mo! Ideas

auto insurance deductibles insurance group insurance coverage insurance group

auto insurance deductibles insurance group insurance coverage insurance group

In any one of these scenarios, an SR-26 type can be submitted by your insurance provider. When that takes place, your insurance firm ought to indicate that you no longer have insurance policy coverage with the entity. Starting the SR-22 process over again will certainly be necessary if your company files an SR-26 prior to completing your SR-22 need - bureau of motor vehicles.

MIS-Insurance offers inexpensive SR22 insurance coverage that will certainly conserve you cash over the life of your plan. Budget friendly SR22 insurance coverage is offered and also we will can help you secure the right policy for you. The reason is that each insurance provider uses its criteria when examining your driving history. ignition interlock. On the other hand, California law bans firms from enhancing rates or canceling your policy in the center of its term.

sr22 coverage department of motor vehicles vehicle insurance division of motor vehicles dui

sr22 coverage department of motor vehicles vehicle insurance division of motor vehicles dui

A DUI will automatically enhance your prices without thinking about added price boosts as well as deny you discounts even if you were previously receiving a great driver discount. Instead of paying $100 monthly for vehicle insurance policy, a motorist with no DUI history will just pay $80 month-to-month, thanks to the 20% excellent chauffeur price cut they get.

Trying to find an SR22 insurance coverage guide that makes the truths clear? Inexpensive SR22 quotes are difficult to find by because the SR22 just puts on an extremely little portion of chauffeurs. Drivers that have been found accountable for a major website traffic violation are assigned "high threat" and needed to hold the SR22 as a problem of continuing to drive. sr22 insurance.

At Low-cost Insurance coverage, we comprehend simply how crucial it is to discover affordable SR22 quotes. The best quote can conserve you numerous bucks a year, especially since SR22 can be really costly. Our team is here to aid so here are the leading inquiries on SR22 insurance policy and their responses.

Indicators on Cheap Sr22 Insurance Chicago & Illinois - Online Sr-22 ... You Should Know

Do all car insurance provider deal SR22? Unfortunately, the solution is no. Many smaller sized companies do not use it, or provide it only at really high prices. Still, you need to purchase SR22 automobile insurance policy immediately as well as make certain you have your automobile insurance policy card handy whenever you drive.

No SR22 insurance overview would certainly be total without reviewing who is in fact needed to hold it - division of motor vehicles. The SR22 cars and truck insurance recommendation is usual for: Chauffeurs convicted of Driving While Intoxicated (DWI) or Driving Under the Influence (DUI) Anybody who has been found responsible for a significant car crime, such as a hit as well as run, People who involve in duplicated website traffic offenses, also if specific occurrences are small, Motorists discovered to be without insurance or under insured at the time of a crash they created, Anyone who has had their driving advantages put on hold temporarily due to a court order.

People throughout the nation have actually taken the chance of driving without insurance coverage and entered into a crash, only to discover that they pay two or 3 times as high as they would have for a typical vehicle insurance coverage. And also, without auto insurance coverage you are not secured from liabilities arising from a mishap. department of motor vehicles.

In "no fault" automobile insurance states, failing to hold Accident Protection (PIP) insurance policy implies you will certainly not have any kind of protection for your medical costs, lost wages, and other mishap prices - car insurance. If you fall short to obtain SR22 after being purchased to do so, charges are extremely severe and also can even include prison time.

Courts usually have broad flexibility to impose the SR22 constraint as well as to remove it. That said, you will usually be needed to hold it for regarding 3 years from the day of conviction or from the date of the qualifying crash. Several states receive a notification directly from the insurance company if you shut your vehicle insurance coverage or fall short to pay and shed your coverage (dui).

The Buzz on Sr22 Insurance: Cost & Cheap Sr-22 Insurance Quotes - 101

We wish this SR22 insurance coverage guide aids you recognize the situation far better than ever. Below at Affordable Insurance coverage, you can compare SR22 insurance coverage prices from loads of business, aiding you discover the best bargain. You can begin now or contact us for more details.